Responsible Investments at GID

At GID, we strive to create supportive and thriving places. Our mission is to enhance the communities in which we invest, live, and operate.

- Resourceful

- Respectful

- Responsible

- Resilient

These four words represent our Responsible Investments principles, ensuring alignment between our financial and sustainability objectives.

We believe ethical and sustainable practices are essential to the long-term success of our business, which is why in 2024, we continued to integrate our principles into our ways of working. As we develop new strategies and recognize opportunities for growth, these principles will support sustainable progress, guiding us to continue delivering excellent results for our investors, residents, tenants, associates, and communities.

Our 2024 Highlights

- 20.8% reduction in energy use since 20171

- 17.4% reduction in greenhouse gas (GHG) emissions from baseline2

- 27.6% of waste diverted from landfill in 2024

- 27,818 training modules completed by employees on our in-house Learning Management System

- 2nd place in the GRESB Real Estate Assessment – six consecutive years in the top five14

- ENERGY STAR Partner of the Year Award3

- Green Lease Leaders Award Winners across both Multifamily and Industrial assets5

- LEAP Award 2024 Sustainable Fund6

- Multi-Housing News (MHN) Best ESG Program Finalist7

Our Leadership

“2024 was a landmark year in our sustainability journey and we are honored to have that recognized by several external bodies. From our consistent high ranking GRESB performance14 and being named ENERGY STAR Partner of the Year3 to our Windsor team receiving the Grace Hill Kingsley Excellence Award for Resident Satisfaction10 for the fourth year in a row, these accolades reflect our ongoing commitment to leading our industry toward a more resilient future.”

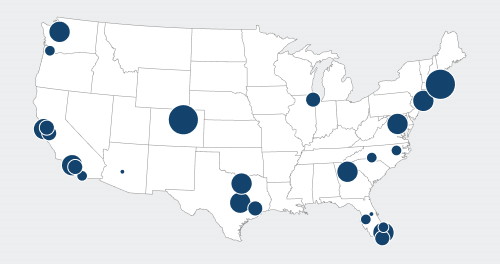

Our Properties

The map shows our properties and corporate offices by state. The size of the circle represents property value per state.

Multifamily

Listed in increasing property value

Up to $200 million

- Arizona

- Oregon

$200 million to $2 billion

- Illinois

- North Carolina

- New York

- District of Columbia

- Washington

- Georgia

Over $2 billion

- Colorado

- Florida

- Massachusetts

- Texas

- California

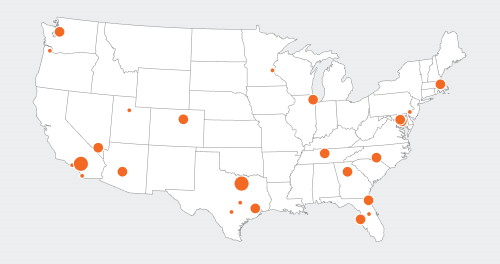

Industrial

Listed in increasing property value

Up to $100 million

- Minnesota

- Pennsylvania

- Oregon

- Utah

$100 million to $200 million

- Tennessee

- Massachusetts

- Washington

- Colorado

- North Carolina

Over $200 million

- Maryland

- Arizona

- Illinois

- Nevada

- Florida

- Georgia

- Texas

- California

Corporate offices

- Atlanta, Georgia

- Boston, Massachusetts

- Dallas, Texas

- New York, New York

- San Francisco, California

GID at a Glance

- $30.3 billionbillion assets under management (AUM)15

- $1.3 billionGID Sponsor Equity

- 56,000+multifamily units

- 26.1 million+square feet of industrial property

- 1,280+employees

- 40markets

- 141properties with at least one green and healthy building certification16, 17

- 107Institute of Real Estate Management (IREM) certifications

- 472024 ENERGY STAR certifications16

- 20LEED and 3 LEED for Homes certifications16

- 12National Green Building Standard (NGBS) certifications16

- 9ActiveScore certifications16

Awards and Recognition16

GID

Partner of the Year Award 20243

GID Multifamily achieved the Platinum level in 2022

GID Industrial achieved the Gold level in 20245

LEAP Award: 2024 Sustainable Fund (Industrial Value Fund I)6

Top five for the sixth consecutive year14

#20 National Multifamily Housing Council (NMHC) 50 Largest Apartment Owners list9

Windsor Communities®

#37 NMHC 50 Largest Apartment Managers list9

Named Property Management Firm of the Year by NAHB as part of the Multifamily Pillars of the Industry Awards12

Winner: MHN Excellence Awards Best ESG Program (Bronze Level)7

127 Windsor Communities® received Kingsley Excellence Awards in 20248

#1 Property Management Company in the nation for the 2025 Kingsley Excellence Award for Resident Satisfaction (the fourth consecutive year)8

24 communities ranked among the 2024 Elite 1% ORA Power Ranking by J Turner Research, achieving a score of 93 or higher13

Explore Responsible Investments at GID

More on Our Responsible Investments Journey

Footnotes

- Energy use reduction is measured using Energy Use Intensity and pertains to multifamily assets in Separate Accounts I & II, excluding assets under construction. ↩

- Greenhouse gas emissions reduction is measured using Greenhouse Gas Use Intensity and pertains to multifamily assets in Separate Accounts I & II, excluding assets under construction. ↩

- GID does not pay a fee to ENERGY STAR, which is a program administered by the U.S. Environmental Protection Agency. ENERGY STAR Partner of the Year award achieved in 2024, and valid for a period of one year. ↩ ↩ ↩ ↩

- Kingsley, a national surveying system that measures resident, employee, and client experience, ranked Windsor Communities® as winner of the Kingsley Surveys Elite 5. This award was given by Grace Hill to Windsor for exceeding the Kingsley Index in resident satisfaction. Windsor pays Kingsley a fee to survey prospects and residents. ↩

- GID does not pay a fee to Green Lease Leaders, which is administered by the Institute for Market Transformation and the U.S. Department of Energy. The Green Lease Leaders Award was achieved for Multifamily in 2022 and Industrial in 2024, and each award is valid for a three-year period. ↩ ↩ ↩

- GID does not pay a fee for HOOPP’s LEAP Sustainability Awards, the award is only open to partners of HOOPP. The Sustainable Fund award was earned in 2024 and is valid for one year. ↩ ↩ ↩

- Multi-Housing News (MHN) recognized GID and Windsor Communities® for their commitment to integrating sustainable practices across their real estate business. Winners of the 2024 MHN Excellence Awards are selected by an independent panel of judges based on self-reported data from all nominees for YE23 and YE24. GID/Windsor paid an entry fee to MHN. Neither GID nor Windsor are affiliated with MHN. More information on the MHN Excellence Awards is provided here. ↩ ↩ ↩

- The Kingsley ranking is based on data from January 2024 to December 2024. Windsor Communities® pays a service fee to Kingsley for its ongoing survey program. GID-Windsor is not affiliated with Kingsley or its affiliates. More information on the Kingsley Index is located here. ↩ ↩ ↩

- National Multifamily Housing Council (NMHC) is a nonprofit organization that advocates for certain policies and standards in the apartment industry. Rankings are from the NMHC 2025 list published on their website based on CY2024 data. Owners. Managers. ↩ ↩ ↩

- Winners of the Grace Hill Impact Hero Award are selected by an independent panel of judges based on self-reported data from all nominees. GID-Windsor is not affiliated with Grace Hill. More information on the Grace Hill Impact Hero Award is provided here. ↩ ↩

- Winners of the 2024 Multifamily Executive (MFE) Awards are selected by an independent panel of judges based on self-reported data from all nominees. GID-Windsor paid an entry fee to Multifamily Executive Magazine. GID-Windsor is not affiliated with MFE. More information on the MFE Awards is provided here. ↩

- Windsor pays an application fee to participate in the NAHB Pillars of Industry Awards. GID-Windsor is not affiliated with NAHB. More information on the NAHB Pillars of the Industry Awards is provided here. ↩ ↩

- Windsor pays a service fee to the Online Reputation Assessment (ORA). The score has been developed by J Turner Research and is the multifamily industry standard for measuring and benchmarking a property’s online reputation. GID-Windsor is not affiliated with J Turner. Ranking as of 2024. More information on the ORA survey is provided here. ↩ ↩

- GID pays a fee to submit individual investment vehicles to GRESB. GID is not affiliated with GRESB. GRESB rankings are for the 2024 results. GRESB rankings include a peer group in 2024 of 43, 43, and 6 for Separate Account I, Separate Account II, and Open End Fund I respectively. 2nd place and top five ranking for the sixth consecutive year pertains specifically to Separate Account I for 2024 GRESB rankings. Details on the real estate assessment and scoring can be found here. ↩ ↩ ↩

- AUM is as of 12/31/2024 and is calculated in compliance with the definition for Assets Under Management (“AUM”) prescribed in INREV’s Global Definitions Database and includes the market value of real estate as well as non-real estate assets (including any cash in the vehicle or mandate) and committed but uncalled capital for which GID provides oversight and investment management services (for internal client capital and third-party capital) in the funds as well as “Other GID Accounts,” (as defined below) and accounts for which GID provides asset management services without an equity investment. Other GID Accounts include proprietary accounts and co-investment joint ventures with unaffiliated investors where the latter maintain significant approval rights over the management of these investments. Such investment vehicles are not considered "securities portfolios" or "private funds" for purposes of the Advisers Act and are not included in the regulatory assets under management reported in Form ADV Part 1A or Part 2A. As of December 31, 2024, the firm’s regulatory assets under management totaled $4.6B. ↩

- GID and Windsor Communities® are not affiliated with any certification awarding bodies or organizations. GID pays prerequisite administration fees to cover application, review, and certification expenses. ↩ ↩ ↩ ↩ ↩ ↩

- Data represents current Green and Healthy Building Certifications from across GID’s multifamily and industrial properties. ↩